The Bigger Picture: Why AP Automation Matters Now

In 2025, Accounts Payable isn’t just about processing invoices — it’s a $2.2 billion opportunity reshaping finance departments across the U.S only.

Accounts Payable (AP) used to be a back-office function that mostly ran on spreadsheets and emails. Today, it’s becoming a central part of business strategy. With companies under pressure to control costs, pay vendors faster, and reduce fraud, automation is no longer optional.

In 2025, AP automation is not just about speed. It’s about smarter workflows, better decisions, and real-time visibility into spending. Let’s look at the most important shifts happening right now — and what they mean for your business.

More companies are realising that poor AP processes hurt more than just the finance team.

Manual invoice entry, slow approvals, and late payments all affect:

- Vendor relationships

- Audit readiness

- Cash flow planning

- Supply chain reliability

- Compliance with ESG and financial reporting

In 2025, finance leaders are asking harder questions: Where does our money go? Can we trust our data? What are we missing? That’s why AP automation is getting serious attention.

What’s Changing in 2025? More Than Just Tech

Smarter Systems That Learn From Behaviour

Machine learning is now part of many AP platforms. These systems learn from past invoice patterns — not just to process them faster, but to flag inconsistencies, avoid duplicate payments, and even suggest changes to approval workflows.

Real-Time Spend Control

Instead of reviewing spend after the fact, AP automation tools now offer real-time tracking. CFOs can see who approved what, how much was spent, and whether the payment aligned with budgets or policies. This matters more than ever as businesses try to stay agile in an unpredictable economy.

Key Shifts in 2025 AP Automation (Not Just the Usual List)

1. From Automation to Optimisation

Many companies have already automated basic invoice processing. The next step is optimizing:

- Reducing exception handling

- Using invoice data for forecasting

- Managing payment timing to improve working capital

It’s not just about doing things faster — it’s about doing them better.

2. Data Quality is a Priority

Bad data causes bad decisions. In 2025, finance teams are investing more in clean invoice data, not just for AP, but for cash flow forecasting, spend analysis, and ESG reporting.

Structured, searchable, and real-time data is now a competitive advantage.

3. Cross-Functional Collaboration Is Expected

AP no longer works in a silo. Procurement, finance, IT, and operations need to work together. For example:

- Procurement sets the vendor terms

- AP processes the payments

- Finance needs the data for cash planning

Automation tools now come with shared dashboards, approval workflows, and audit trails so teams can stay aligned without extra emails or meetings.

4. Dynamic Discounting Gains Traction

In 2025, more companies are using automated systems to take advantage of early payment discounts. Some systems even suggest when to pay based on current cash levels or vendor behaviour.

Dynamic discounting helps both sides — vendors get paid sooner, and buyers save money.

5. Cloud and Mobile Aren’t Just Features — They’re Baselines

AP teams now expect to access invoices, approvals, and reports from anywhere. Systems that don’t support mobile devices, remote logins, or cloud backup are falling behind.

This shift also opens doors for small and mid-sized companies to access powerful tools that were once only available to enterprises.

What’s Often Overlooked (But Critical in 2025)

Advanced Invoice Analytics

Beyond dashboards, some AP tools now offer predictive analytics:

- Will this vendor submit on time?

- Is this invoice likely to be flagged?

- What departments are driving the most non-PO spend?

These insights help drive policy changes and budgeting.

AP’s Role in ESG Reporting

Environmental, Social, and Governance (ESG) compliance is a growing area of concern, especially for companies working with public funds or large supply chains.

AP automation helps by tracking:

- Vendor sustainability ratings

- Payments to minority- or women-owned businesses

- Scope 3 emissions (indirect emissions through suppliers)

This data is hard to gather manually — automation makes it possible.

Embedded Fraud Prevention

Fraud isn’t just about fake invoices. It can be internal too — like approvals being bypassed or vendors being added without proper checks.

Modern systems include:

- Role-based access

- Automated audit trails

- Alerts for policy violations

You no longer have to rely on memory or spot-checking.

What You Should Be Doing Now

If you’re just starting with AP automation, don’t worry. Many companies are still catching up. But the key is to start strategically. Look for:

- Systems that integrate with your ERP (like NetSuite)

- Tools that handle approvals, payments, and reporting in one place

- Dashboards that show what’s happening in real time, not just at month-end

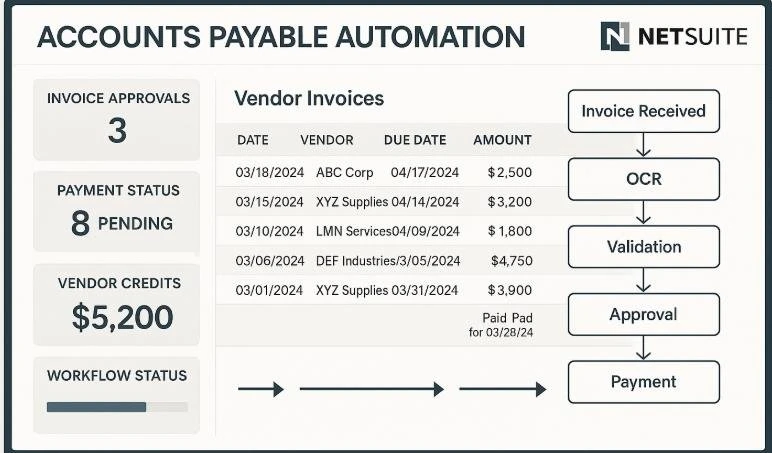

Take Advantage of Automation With NetSuite

NetSuite offers built-in AP automation tools that connect invoice capture, approvals, and payments directly with your financials. Its real-time dashboards give you visibility into spend, while automated workflows help reduce manual effort and errors.

If you’re using or considering NetSuite, AP automation becomes even more powerful because it’s already tied into your broader ERP, giving you control and insights across the entire business.

If you’re already automated, the next step is using your data to improve decisions. Ask:

- Are we using discounts effectively?

- Where are exceptions slowing us down?

- Can our AP data support ESG or risk reporting?

Final Thoughts

In 2025, AP automation is about more than going paperless. It’s about building a smarter, safer, and more connected finance function — one that works in real time, helps manage risk, and improves how money flows through your business.

Whether you’re just starting or fine-tuning your process, the goal is the same:

Less manual work, better decisions, and full control over every dollar going out.

Frequently Asked Questions

Why is Accounts Payable (AP) automation important in 2025?

In 2025, AP automation is key to controlling costs, avoiding fraud, speeding up payments, and gaining better visibility into cash flow. It’s no longer just a back-office function — it’s a strategic part of finance.

How big is the AP automation market?

In the U.S. alone, AP automation is now a $2.2 billion market and growing, reflecting its importance in modern finance operations.

What’s the difference between traditional AP and automated AP?

Traditional AP relies on spreadsheets and emails. Automated AP uses software to manage invoices, approvals, payments, and data in real time, reducing errors, delays, and manual work.

What new technologies are being used in AP automation?

Modern AP systems use machine learning to flag errors, detect duplicate invoices, suggest workflows, and offer real-time tracking of spend and approvals.

What are the key trends in AP automation for 2025?

-

- Smarter systems that learn from behaviour

- Real-time spend control

- Optimisation, not just automation

- Focus on data quality

- Better cross-team collaboration

- Dynamic discounting

What does “optimisation” mean in the context of AP automation?

-

It means going beyond automating tasks to improving processes, like using invoice data for forecasting, handling fewer exceptions, and managing payments to improve cash flow.

Why is clean AP data so important now?

Clean data helps with better cash flow planning, ESG reporting, and spend analysis. Bad data can lead to poor decisions and financial risk.

How is AP automation improving collaboration between departments?

Modern tools connect AP, finance, procurement, and IT using shared dashboards, workflows, and audit trails, reducing the need for emails and manual coordination.

What is dynamic discounting ,and why does it matter?

Dynamic discounting allows companies to pay invoices early in exchange for discounts. Automation tools can help decide the best time to pay based on cash availability or vendor terms.

Are cloud and mobile access really necessary for AP?

Yes. In 2025, AP teams expect access from anywhere. Systems without mobile support or cloud backup are becoming outdated.

What makes NetSuite a good option for AP automation?

NetSuite has built-in AP automation that ties directly to financials. It offers invoice capture, approvals, payments, and dashboards — all in one ERP system, improving accuracy and visibility.